Balance sheets are useful tools for individual and institutional investors, as well as key stakeholders within an organization, as they show the general financial status of the company. Appvizer provides you with a glossary to clarify these concepts and help you manage your business with peace of mind. Dear auto-entrepreneurs, yes, you too have accounting obligations (albeit lighter ones!). Accounting books, annual accounts, compulsory chartered accountants… From understanding the rates that apply, to choosing the scheme and making the declaration, we cover everything you need to navigate the world of VAT with peace of mind.

Examples of balance sheet analysis

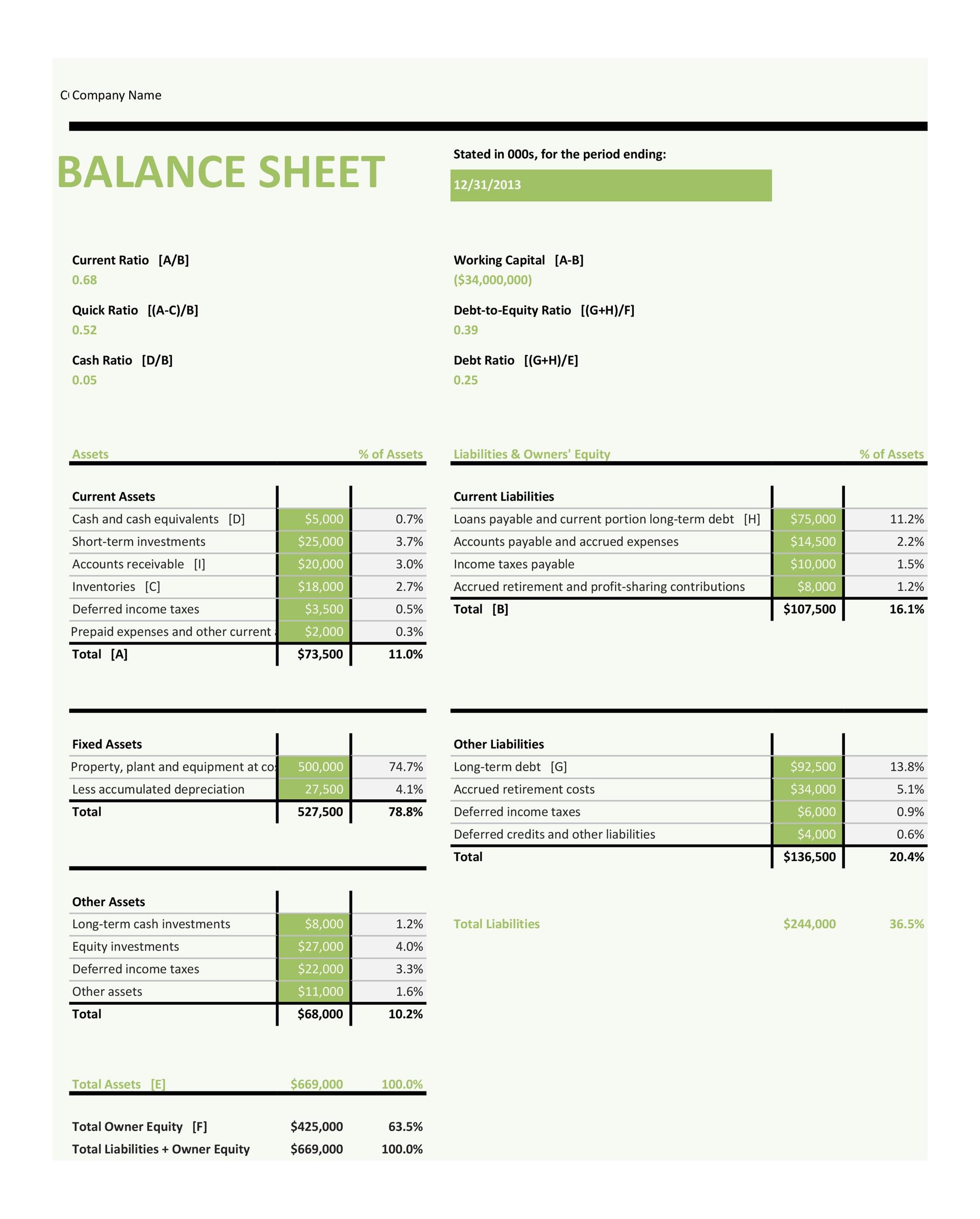

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Activity ratios mainly focus on current accounts to reveal how well the company manages its operating cycle. Financial strength ratios can include the working capital and debt-to-equity ratios. As you can see, it starts with current assets, then the noncurrent, and the total of both.

Frequently Asked Questions About Balance Sheets

A balance sheet is also different from an income statement in several ways, most notably the time frame it covers and the items included. Some financial ratios need data and information from the balance sheet. Using financial ratios in analyzing a balance sheet, like the debt-to-equity ratio, can produce a good sense of the financial condition of the company and its operational efficiency.

Balance Sheets Examine Risk

A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. Noncurrent or long-term liabilities are debts and other non-debt financial obligations that seek bromance a company does not expect to repay within one year from the date of the balance sheet. The term owners’ equity is mostly used in the balance sheet of sole proprietorship and partnership form of business.

FAQs About Balance Sheets

In other words, it shows you how much cash you have readily available. It’s wise to have a buffer between your current assets and liabilities to at least cover your short-term financial obligations. The data from financial statements such as a balance sheet is essential for calculating your business’ liquidities.

Balance Sheets are Needed for Financial Ratios

- Some companies issue preferred stock, which will be listed separately from common stock under this section.

- Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet.

- If Companies House requires it, an accountant is the best person to prepare and submit the accounts, as they will know the generally accepted accounting principles.

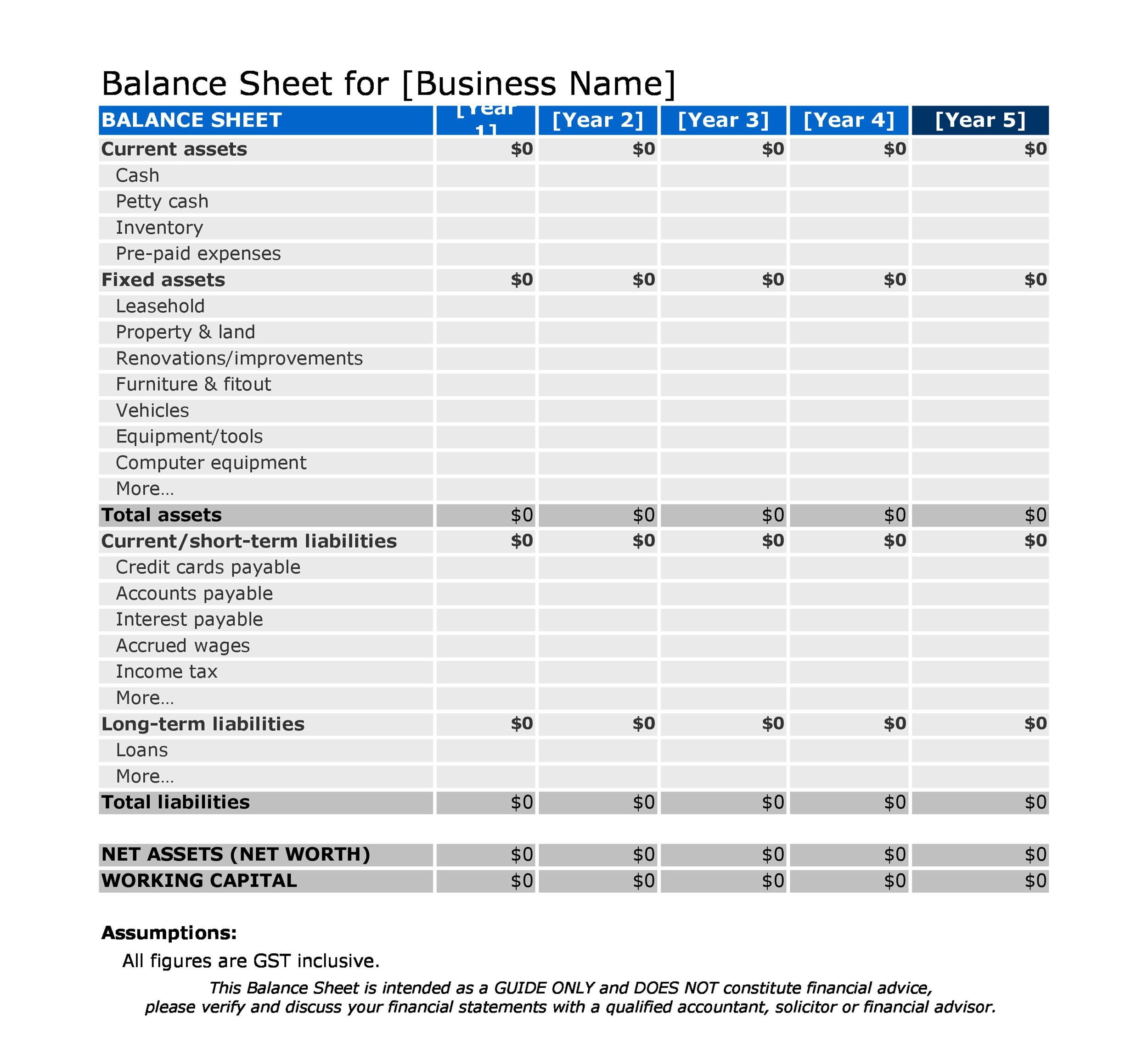

The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. It reports a company’s assets, liabilities, and equity at a single moment in time. You can think of it like a snapshot of what the business looked like on that day in time. When paired with cash flow statements and income statements, balance sheets can help provide a complete picture of your organization’s finances for a specific period. By determining the financial status of your organization, essential partners have an informative blueprint of your company’s potential and profitability.

In financial reporting, the terms « current » and « non-current » are synonymous with the terms « short-term » and « long-term, » respectively, and are used interchangeably. The balance sheet is basically a report version of the accounting equation also called the balance sheet equation where assets always equation liabilities plus shareholder’s equity. In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts.

Liabilities represent financial obligations a company must fulfil in the future, including loans and lease payments. These obligations are classified as either current liabilities, due within the forthcoming year, or long-term liabilities, due beyond a year. It lets you see a snapshot of your business on a given date, typically month or year-end. It is also a valuable tool for management to know the value of assets a business owns, including equipment, bank balance and what it owes at any given time.

In this article, we will discuss different scenarios to understand how values are reflected in the balance sheet accounts. Asset accounts will be noted in descending order of maturity, while liabilities will be arranged in ascending order. Under shareholder’s equity, accounts are arranged in decreasing order of priority. An asset is something that the company owns and that is beneficial for the growth of the business.

Shareholders’ equity belongs to the shareholders, whether they’re private or public owners. Once complete, we’ll undergo an interactive training exercise in Excel, where we’ll practice building a balance sheet template using the historical data pulled from the 10-K filing of Apple (AAPL). Conceptually, a company’s assets refer to the resources belonging to the company with positive economic value, which must have been funded somehow. By looking at the sample balance sheet below, you can extract vital information about the health of the company being reported on. On the other hand, long-term liabilities are long-term debts like interest and bonds, pension funds and deferred tax liability.